Forestry in the NZ ETS

Forestry in the NZ ETS is a regulatory framework managed by the Ministry for Primary Industries that incentivizes carbon sequestration. It allows owners of Post-1989 forest land to earn New Zealand Units (NZUs) for carbon storage, while imposing surrender liabilities on Pre-1990 land owners who deforest, utilizing accounting methods like Averaging to align with the Zero Carbon Act.

The New Zealand Emissions Trading Scheme (NZ ETS) stands as the government’s primary tool for meeting domestic and international climate change targets. For landowners, investors, and rural stakeholders, understanding the intersection of forestry and carbon trading is no longer optional—it is a critical component of land management strategy. Whether you are managing indigenous regeneration or exotic plantations, the rules governing carbon credits can significantly impact asset value and operational cash flow.

What is the difference between Post-1989 and Pre-1990 Forest Land?

The architecture of forestry in the NZ ETS is built upon a single, critical date: December 31, 1989. This temporal boundary determines whether a piece of land enters the scheme as a potential liability or as an income-generating asset. Misidentifying land status is the most common error in carbon forestry due diligence.

Pre-1990 Forest Land: The Baseline

Pre-1990 forest land is defined as land that was forest on December 31, 1989, and remained predominantly exotic forest on December 31, 2007. The guiding principle here is the preservation of the carbon baseline.

Owners of Pre-1990 forest land generally cannot earn NZUs (New Zealand Units) for the carbon their trees sequester. The government assumes this carbon was already part of the atmospheric baseline. However, this land carries a significant liability. If you choose to “deforest” this land—defined as clearing the trees and changing the land use (e.g., to dairy farming or residential development)—you face a mandatory obligation to surrender NZUs to the government to cover the emissions released.

There are limited exemptions, such as:

- Tree Weed Exemptions: For clearing wilding pines or other invasive species.

- Less than 50 Hectares: Certain exemptions exist for smaller landowners who owned the land prior to 2002.

Post-1989 Forest Land: The Opportunity

Post-1989 forest land is land that was not forest on December 31, 1989, or was forest then but was deforested between 1990 and 2007. This category represents the primary opportunity for carbon farming.

Participation for Post-1989 forests is voluntary (unless you are entering the Permanent Forest category under specific conditions). If you register this land in the NZ ETS, you can claim NZUs for the increase in carbon stock as the trees grow. Conversely, you must surrender units if the carbon stock decreases (e.g., through harvesting or fire) or if you deregister the land. This category is the engine room of New Zealand’s afforestation strategy under the Zero Carbon Act.

How do Averaging Accounting Rules work?

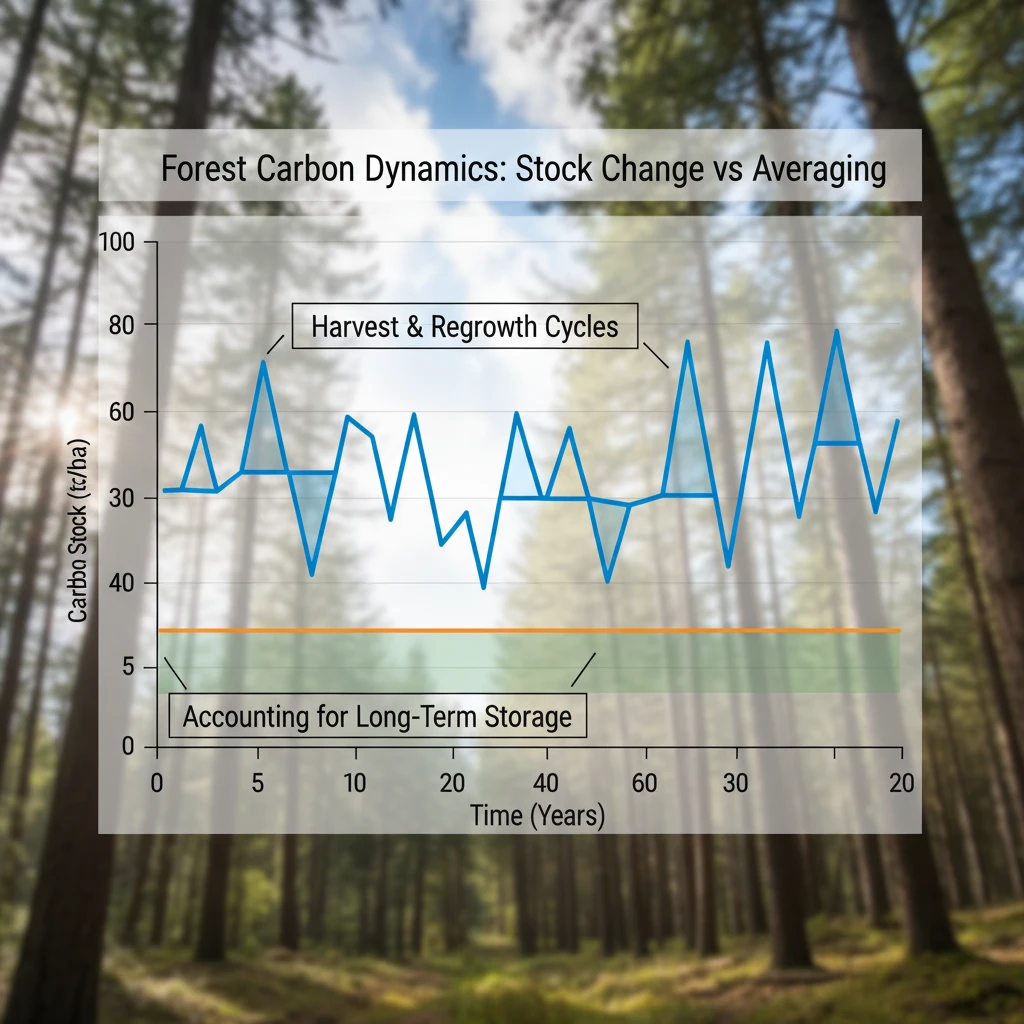

Historically, the NZ ETS used “Stock Change” accounting. Under Stock Change, participants earned credits as trees grew and surrendered a massive portion of them upon harvest. This created a “sawtooth” cash flow profile that was risky for many investors. To mitigate this and simplify the scheme, the government introduced Averaging Accounting.

The Mechanics of Averaging

Averaging accounting removes the liability for harvesting, provided the forest is replanted. Instead of earning credits until the tree reaches full maturity (and then paying them back at harvest), participants earn credits only up to the forest’s long-term “average” carbon stock over multiple rotations.

Key features include:

- Earn Early, Stop Early: You earn NZUs typically for the first 16 to 20 years (depending on the species and region) for Pinus radiata. Once the forest reaches its calculated average carbon volume, credit allocation stops.

- Harvest Freedom: When you harvest the timber, you do not need to surrender units, as long as you replant the area. This decouples the carbon asset from the timber asset, allowing foresters to sell the carbon credits early in the rotation without fearing a future liability.

- Mandatory for New Entrants: As of 2023, Averaging is the mandatory accounting method for newly registered Post-1989 exotic forests (standard category).

Impact on Valuation

Averaging provides greater certainty. It creates a low-risk, upfront yield of carbon credits that can be sold to fund establishment costs or infrastructure. It aligns perfectly with production forestry, ensuring that the NZ ETS supports a sustainable timber industry rather than just permanent carbon sinks.

What is the Permanent Forest Category?

The Permanent Forest Category is a relatively new addition to forestry in the NZ ETS, designed to replace the old “Permanent Post-1989” activity. It targets landowners who intend to leave forests standing for the long term, contributing to New Zealand’s biodiversity and climate resilience.

Rules of the Permanent Category

Entering this category is a significant commitment. The key constraints and benefits include:

- 50-Year Ban on Clear-felling: Once registered, the land cannot be clear-felled for at least 50 years. Limited selective harvesting is permitted (Continuous Cover Forestry), but the canopy cover must remain intact.

- Stock Change Accounting: Unlike the standard category which uses Averaging, the Permanent category typically uses Stock Change accounting. This means you continue to earn credits as long as the forest is growing, potentially for significantly longer than the 16-20 year averaging band.

- Exotic vs. Indigenous: While initially open to exotics (like Radiata Pine), the government has implemented strict controls and is reviewing the role of permanent exotic forests due to concerns over “carbon farming” displacing productive farmland. Indigenous forests are strongly encouraged in this category.

Indigenous Forestry Incentives

For native forests, the Permanent Category is ideal. Native trees grow slower but sequester carbon for centuries. The Stock Change approach allows landowners to earn credits for 50, 80, or even 100+ years, providing a long-tail revenue stream that supports conservation and pest control efforts.

How to Register for the NZ ETS?

Registration is managed by Te Uru Rākau (New Zealand Forest Service) within the Ministry for Primary Industries (MPI). The process is rigorous and requires high-quality geospatial data.

Step-by-Step Registration Process

- Land Eligibility Assessment: Confirm the land is Post-1989 forest land. This often requires historical aerial photography analysis to prove the land was pasture or scrub in 1989.

- Mapping: You must submit digital shapefiles mapping the Carbon Accounting Areas (CAAs). These maps must meet strict geospatial standards (accurate to within meters).

- Emissions Return: Once registered, you must file regular Emissions Returns (usually every 5 years, or annually if you choose). This is where you calculate the change in carbon stock and claim your NZUs.

- Field Measurement Approach (FMA): For forests over 100 hectares, you cannot rely on default lookup tables. You must establish physical sample plots and measure actual tree growth to determine carbon sequestration rates.

Economics, Liabilities, and Market Risks

While forestry in the NZ ETS offers lucrative returns, it is not a passive investment. It carries specific liabilities that are attached to the land title.

The Liability of Adverse Events

If a registered forest burns down or is destroyed by windthrow, the carbon stock decreases. Under the rules, the landowner may be liable to surrender NZUs equivalent to the carbon lost. However, the government has introduced mechanisms where, provided the forest is replanted (or regenerates), the liability can be paused or managed, recognizing that the carbon will be re-sequestered.

Price Volatility

The revenue from forestry in the NZ ETS depends entirely on the spot price of NZUs. This market is influenced by government policy, auction floor prices, and the Cost Containment Reserve (CCR). Political changes regarding the Zero Carbon Act can cause price fluctuations. A savvy strategy often involves holding units and selling them strategically rather than immediately upon allocation.

Look-up Tables vs. Measurement

Small forests (<100ha) use regional look-up tables which estimate growth based on averages. If your forest grows faster than the average, you lose out on potential credits. If it grows slower, you gain. Large forests (>100ha) must measure. Understanding which regime applies to you is vital for financial modeling.

People Also Ask (PAA)

Can I harvest my forest if it is in the NZ ETS?

Yes, you can harvest Post-1989 forests. If you are under Averaging Accounting, you do not need to surrender units upon harvest provided you replant. If you are under the old Stock Change rules, you must surrender units for the carbon removed. Permanent Category forests cannot be clear-felled for 50 years.

How much is a carbon credit worth in NZ?

The price of a New Zealand Unit (NZU) fluctuates based on market supply and demand. Historically, prices have ranged significantly, often trading between $60 and $85 NZD in recent years, though investors should check current market data from the NZX or carbon brokers for real-time pricing.

What qualifies as Post-1989 forest land?

Land qualifies if it contains forest species that can reach at least 5 meters in height and 30% canopy cover, and was not forest land on December 31, 1989. It must also cover at least one hectare with an average width of at least 30 meters.

Do native trees earn carbon credits in NZ?

Yes, indigenous forests are eligible for the NZ ETS provided they meet the Post-1989 definition. While they sequester carbon slower than exotic pines, they can earn credits for a longer duration and are often favored in the Permanent Forest Category.

What happens if my ETS forest burns down?

If a registered forest is destroyed by fire, it is treated as an emissions event. However, under current rules, you may not be required to surrender units immediately if you replant or allow the forest to regenerate, effectively “pausing” the carbon accounting until the forest recovers.

Is it mandatory to join the ETS for forestry?

Joining the ETS is voluntary for Post-1989 forest owners who want to earn credits. However, it is mandatory to notify the government if you are deforesting Pre-1990 land, as this triggers a surrender liability.